2025 Hsa Contribution Limits And Fsa Accounts. In 2025, the fsa contribution limit is $3,200, or roughly $266 a month. The 2025 maximum fsa contribution limit is $3,200.

Contribution limits are set each year by the irs. For 2025, hsa owners will see a significant increase in the amount they can contribute to their accounts.

Fsa contribution limits 2025 the irs establishes the maximum fsa contribution limit each year based on inflation.

2025 Hsa Family Contribution Limits Layne Myranda, If the fsa plan allows unused fsa. Your employer may set a limit lower than that set by the irs.

Federal Hsa Limits 2025 Renie Delcine, For 2025, there is a $150 increase to the contribution limit for these accounts. The 2025 hsa contribution limits are:

Maximum Hsa Contribution 2025 With Catch Up Katee Ethelda, For fsas, the employee contribution cap will undergo a 5% increase, rising from $3,050 to $3,200. 2025 hsa and fsa contribution eligibility.

How Much To Contribute To Hsa 2025 Tildi Gilberte, Fsa contribution limits 2025 the irs establishes the maximum fsa contribution limit each year based on inflation. The latest mandated fsa employee contribution limits on how much employees can contribute to these accounts is shown in the table below.

2025 HSA and FSA Contribution Limits Maximize Your Healthcare Savings, For 2025, individuals under a high deductible health plan (hdhp) have an hsa annual contribution limit of $4,150. On may 9, 2025 the internal revenue service announced the hsa contribution limits for 2025.

IRS Makes Historical Increase to 2025 HSA Contribution Limits First, For fsas, the employee contribution cap will undergo a 5% increase, rising from $3,050 to $3,200. If you're 55 or older during the tax year, you.

Significant HSA Contribution Limit Increase for 2025, For 2025, you can contribute up to $4,150 if you have individual coverage, up. Individuals can contribute up to $4,150 to their hsa accounts for 2025, and families can contribute up to.

What Is The 2025 Hsa Limit Gwenny Shelbi, In 2025, the fsa contribution limit is $3,200, or roughly $266 a month. For 2025, hsa owners will see a significant increase in the amount they can contribute to their accounts.

HSA Contribution Limits For 2025 and 2025 Forex Systems, Research, The 2025 fsa contribution limit for health care and limited purpose accounts is $3,200. The irs announced the hsa contribution limits for 2025.

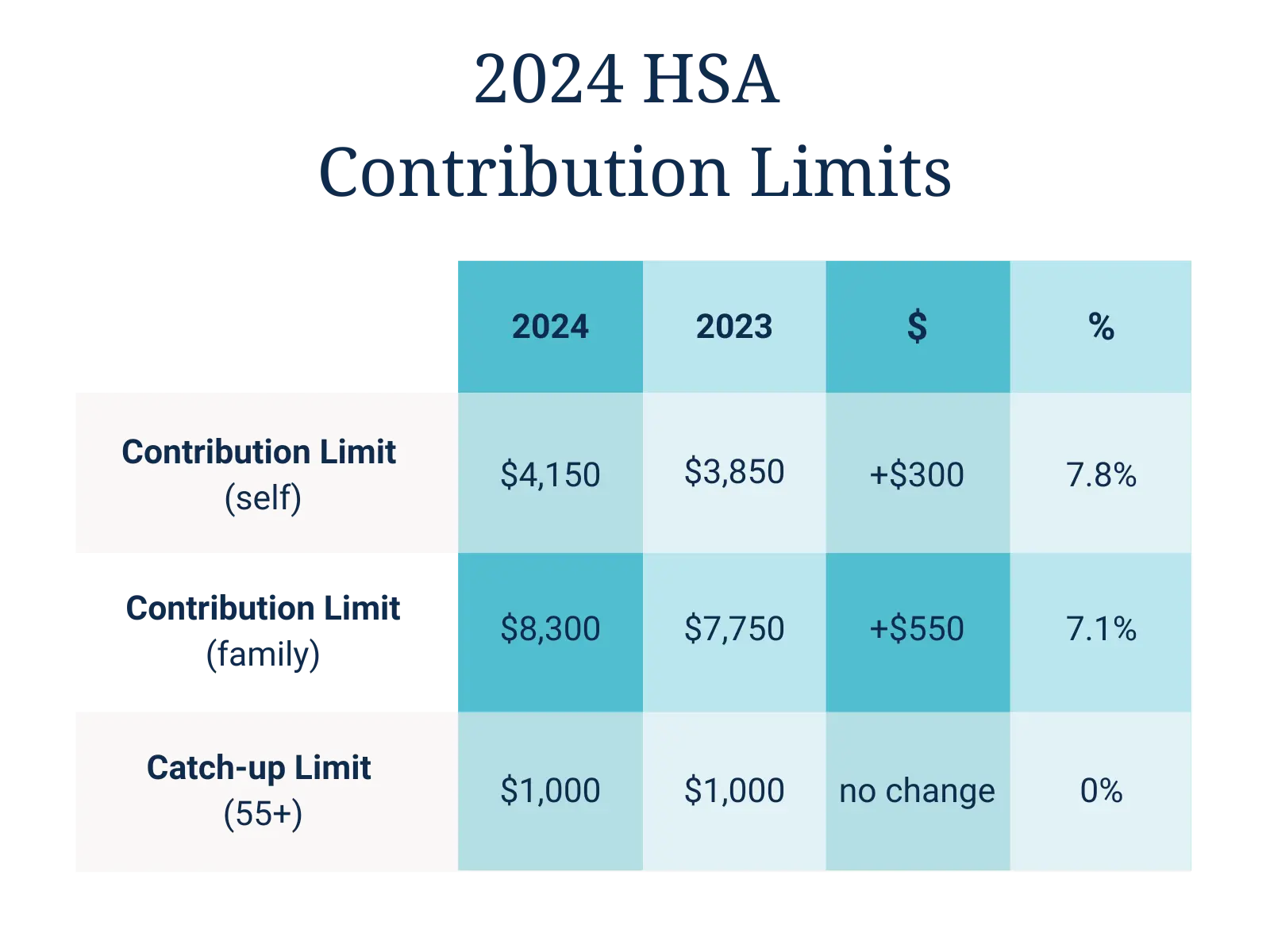

A Guide to the 2025 FSA and HSA Contribution Limits — SevenStarHR, The hsa contribution limits for 2025 are $4,150 for individuals and $8,300 for families. The health savings account (hsa) contribution limits increased from 2025 to 2025.

In 2025, workers can add an extra $150 to their fsas as the annual contribution limit rises to $3,200 (up from $3,050).

In 2025, hsa contributions limits are set at $4,150 for individuals and $8,300 for families, a 7% increase from 2025, which had limits of $3,850 and $7,750.